Unconventional monetary policy and stock repurchases: Firm-level evidence from a comparison between the United States and Japan |

| |

| Affiliation: | Faculty of Economics, Hannan University, 5-4-33, Amami Higashi, Matsubara-shi, Osaka, 580-8502, Japan |

| |

| Abstract: |

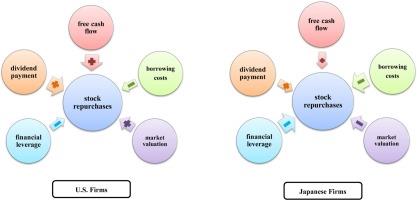

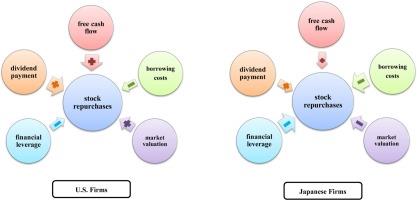

This paper is the first comparative study examining the determinants of stock repurchases during the period of unconventional monetary policy. By constructing a vast firm-level dataset of the U.S. and Japan and conducting multivariate Tobit and probit analyses, this paper presents evidence that during the period of unconventional monetary policy, in both the U.S. and Japan, firms with more free cash flow and lower borrowing costs are more likely to repurchase stock, firms with higher financial leverage are more likely to abstain from stock repurchases, and firms coordinate dividends and stock repurchases to please shareholders. I also find striking contrasts between the results of U.S. and Japanese firms, and show the importance of financial structure in explaining the contrasting results. From a micro perspective, this paper provides new insight and evidence to support the view that financial structure should be thought of as an important factor determining the effects of unconventional monetary policy. |

| |

| Keywords: | Unconventional monetary policy Stock repurchase Financial structure |

| 本文献已被 ScienceDirect 等数据库收录! |

|